Download: Video | Transcript

Hey, hey, what’s up, my friend?

In today’s video, I’ll walk you through how to execute and implement the MOMO stock trading system.

This trading system trades once a month, on the first trading day of the month.

It could be any day of the week, including Monday, Tuesday, Wednesday, Thursday, or Friday.

It really depends on the month that we are trading.

I’ve seen it happen on Monday all the way to a Friday.

So just be aware, it’s always on the first trading day of the month.

Again, if you want to be notified, I’m sure you’re in our Telegram private community for UST members.

We usually send updates whenever the MOMO stock trading or the portfolio tracker is updated.

So stay engaged in the community, and you will never miss the trading signals for the MOMO stock trading system.

On the first trading day of the month.

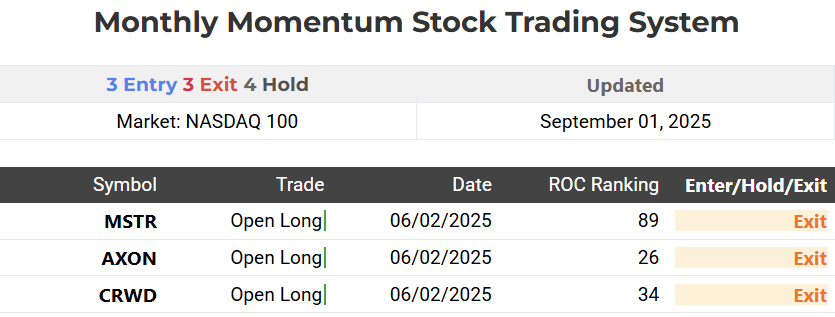

What you need to do every month is go down to the portfolio tracker.

You can find it in the bonus section or in your dashboard.

Just go to the dashboard, you can see the portfolio tracker, and click on this;

Then go to MOMO.

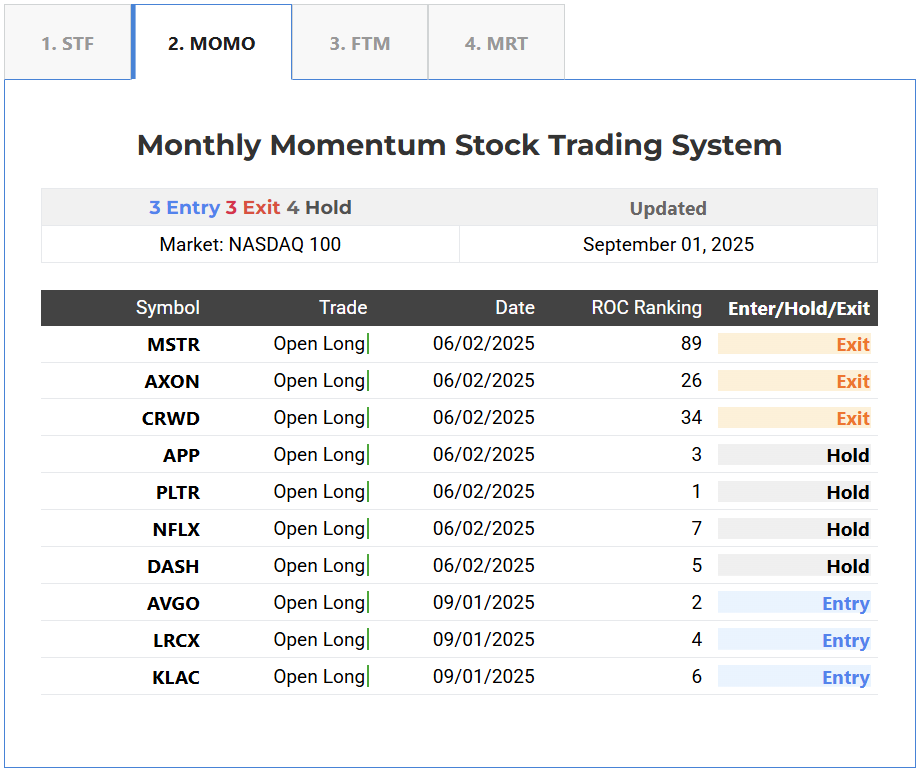

I’m shooting this video on 18th September, 2025.

This signal was updated on 1st September, 2025.

You need to sell MSTR, AXON, and CRWD.

So sell those stocks in your brokerage account.

It should be simple, right?

If you do not know how to do it for whatever reason, just reach out to us, and we’ll walk you through step by step.

But I believe most of you watching this should have no problem.

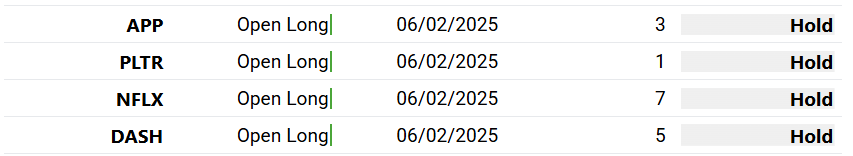

We need to HOLD these positions.

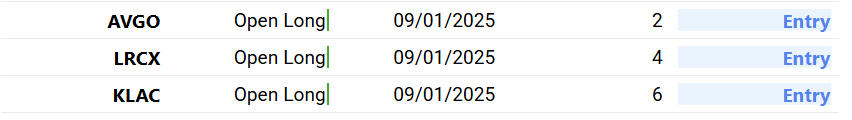

Then we have 3 new positions to ENTER.

So, this is what I’m going to do.

I’m going to walk you through how to enter these stocks on your brokerage account, how to know how many shares to buy, etc.

Example 1

If you recall…

Let’s talk about AVGO.

The thing about this is that I’m going to go down to TradingView and find out what the closing price of AVGO is, because we usually enter this on a market order.

AVGO Broadcom Inc. closed at $346.

Usually, I just use the previous day’s closing price to calculate my position size to know how many stocks to buy.

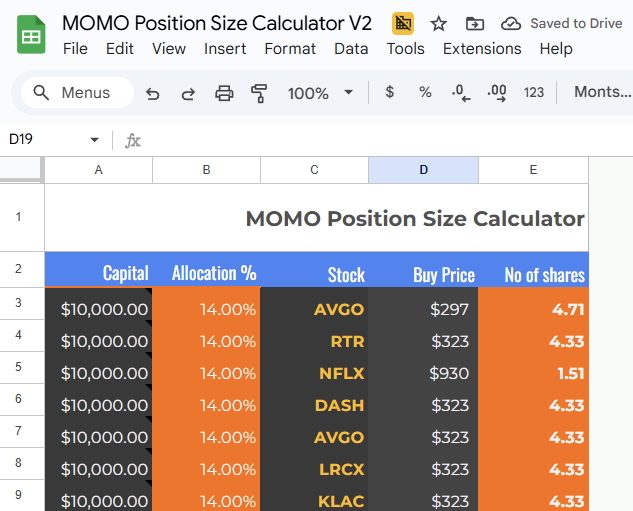

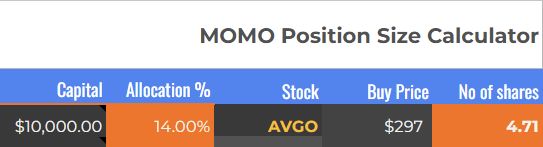

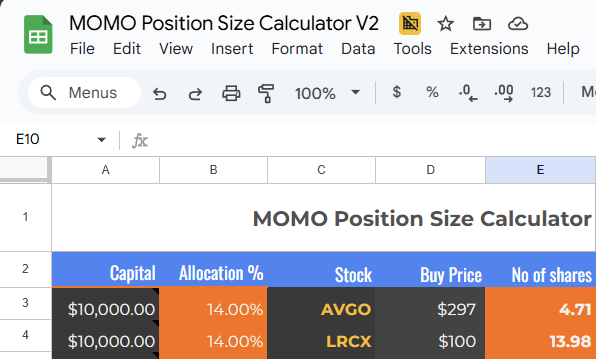

MOMO Position Sizing Calculator

What we need to do next is to go to a position sizing calculator.

Over here, assuming I don’t know what the size or the amount of trading capital you want to allocate to the MOMO stock trading system.

I just put $10,000, but for those of you who want to allocate more, $20,000-50,000, whatever, I’ll leave it to you.

For the capital allocation, I’ll put 14%.

To be precise, it’s supposed to be 14.28%, but I round it down to make life easier, right?

14% of our capital will be allocated to each stock.

If we have a maximum of 7 stocks, you will see that we allocate up to 98% of our capital.

So about 2% will be idle.

You can be precise, 14.2% or if you want to round up to 15%, you can as well.

I leave it to you; the difference is too insignificant to even matter.

Entry Signal (Buy)

On the first trading day of September.

2nd September 2025. Which is on a Tuesday.

You put the buy price of $297 on our position sizing calculator.

Which you derive from the previous day’s closing price.

I need to buy about 4.7 shares for AVGO.

So again, you will often see decimal points of fraction shares.

You have a choice.

You can either round down or round up.

If you’re going to be more conservative, round down to 4 shares.

But if you don’t mind, just taking a little bit more risk, or maybe you know that you have an extra 2% buffer since you’re using 14% capital allocation per stock, you can round it up to 5 shares.

It’s fine as well.

I’ll leave it to you, whether you’re on a roundup or rounddown.

Again, the long-term results will be too insignificant to even matter.

Let’s say in this case, we round up since we have the extra 2% buffer.

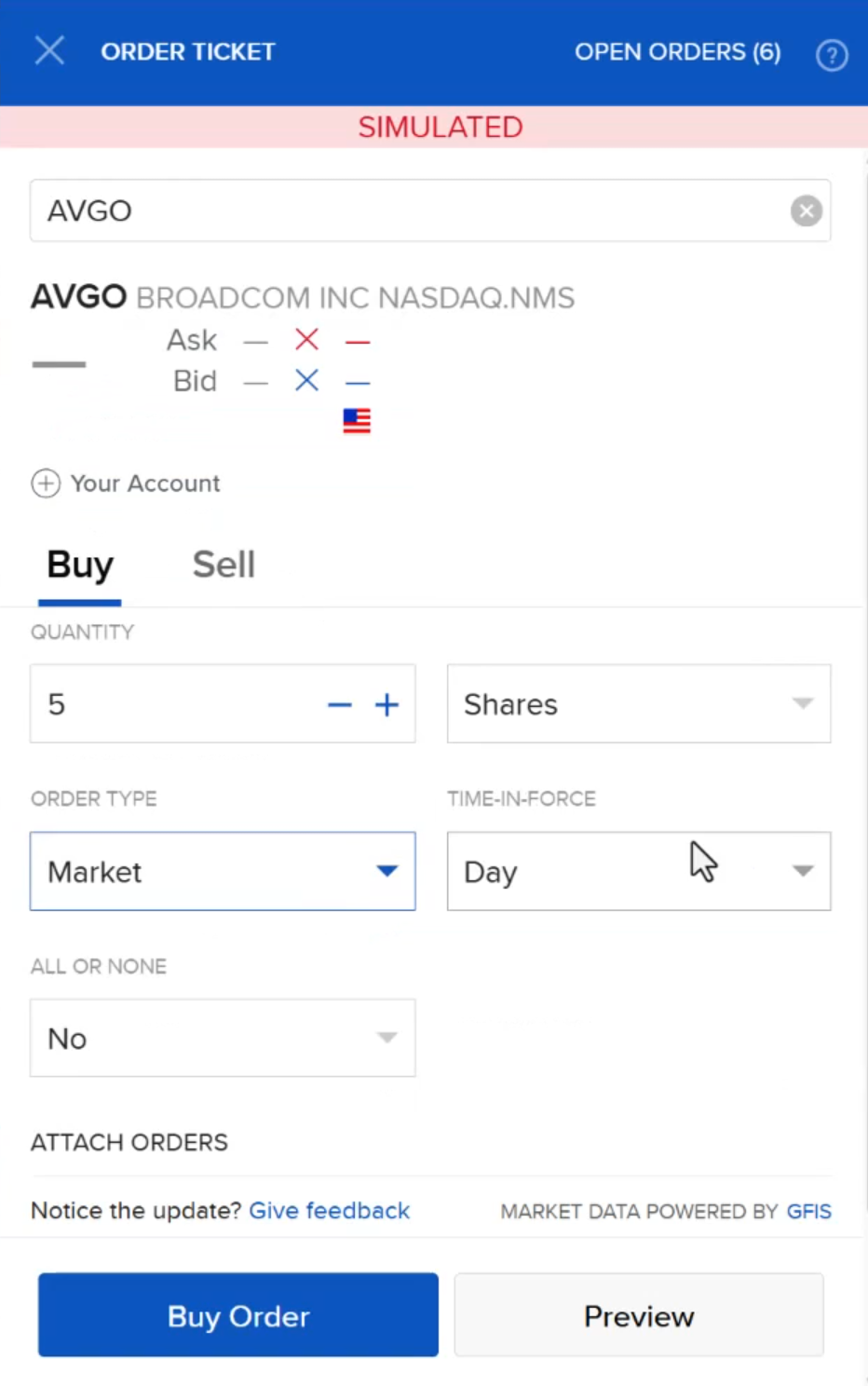

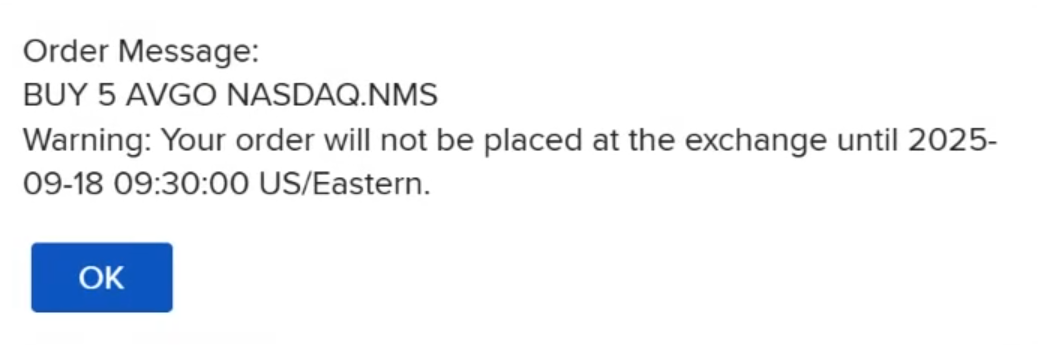

So, 297, and we buy 5 shares.

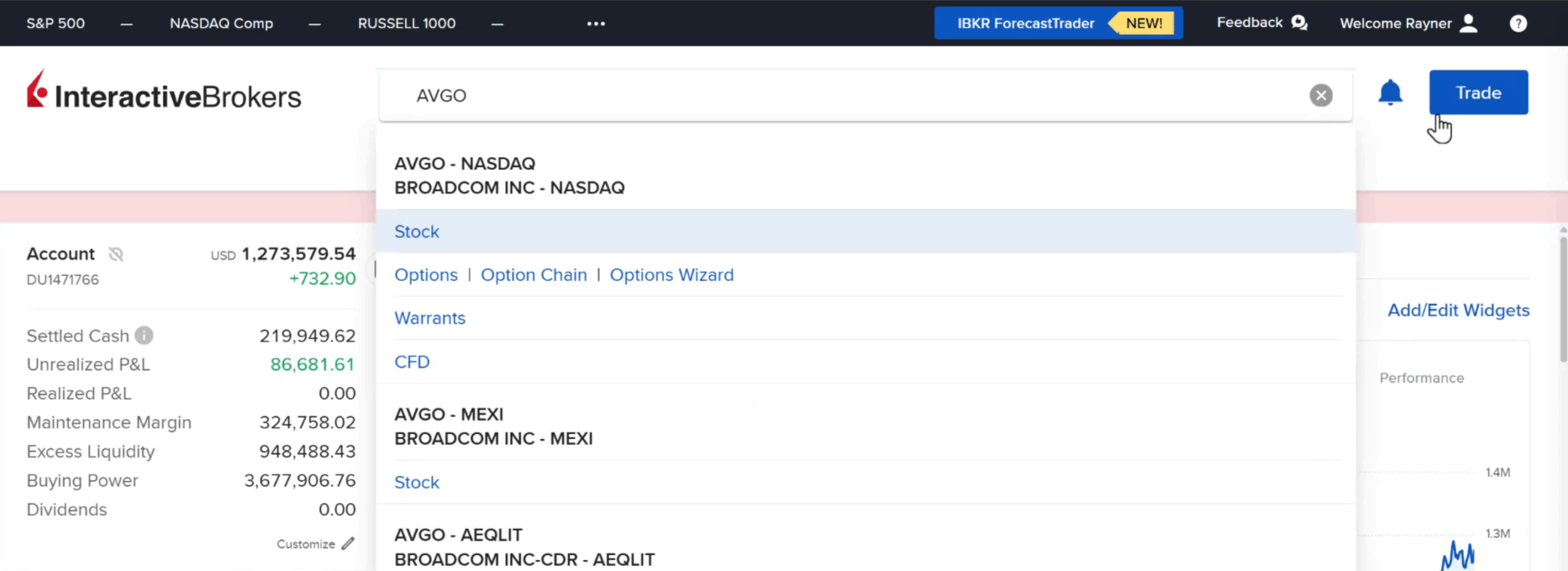

What you’re going to do is go down to your brokerage account.

Search for AVGO, just click trade.

I’ll buy 5 shares.

We’re going to use a market order, and we simply click the buy order.

They will submit to the brokerage account, and you are done.

The trade is submitted to the exchange, and later on, when the market opens, you buy 5 shares of AVGO at the market price.

Another way of calculating a position size is, since you know each stock you’re supposed to buy about $1,400 worth, because 14% of 100 is $1400.

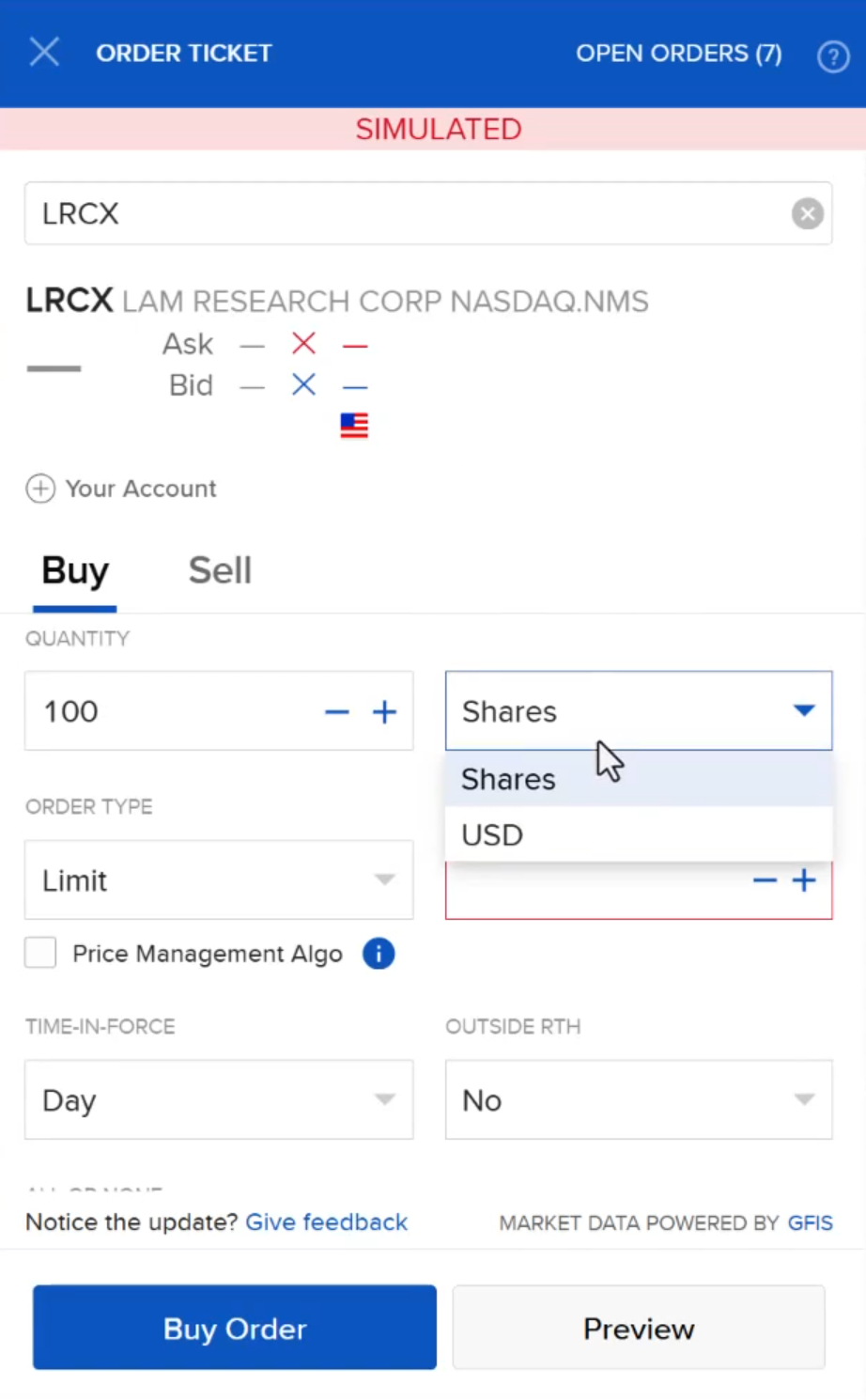

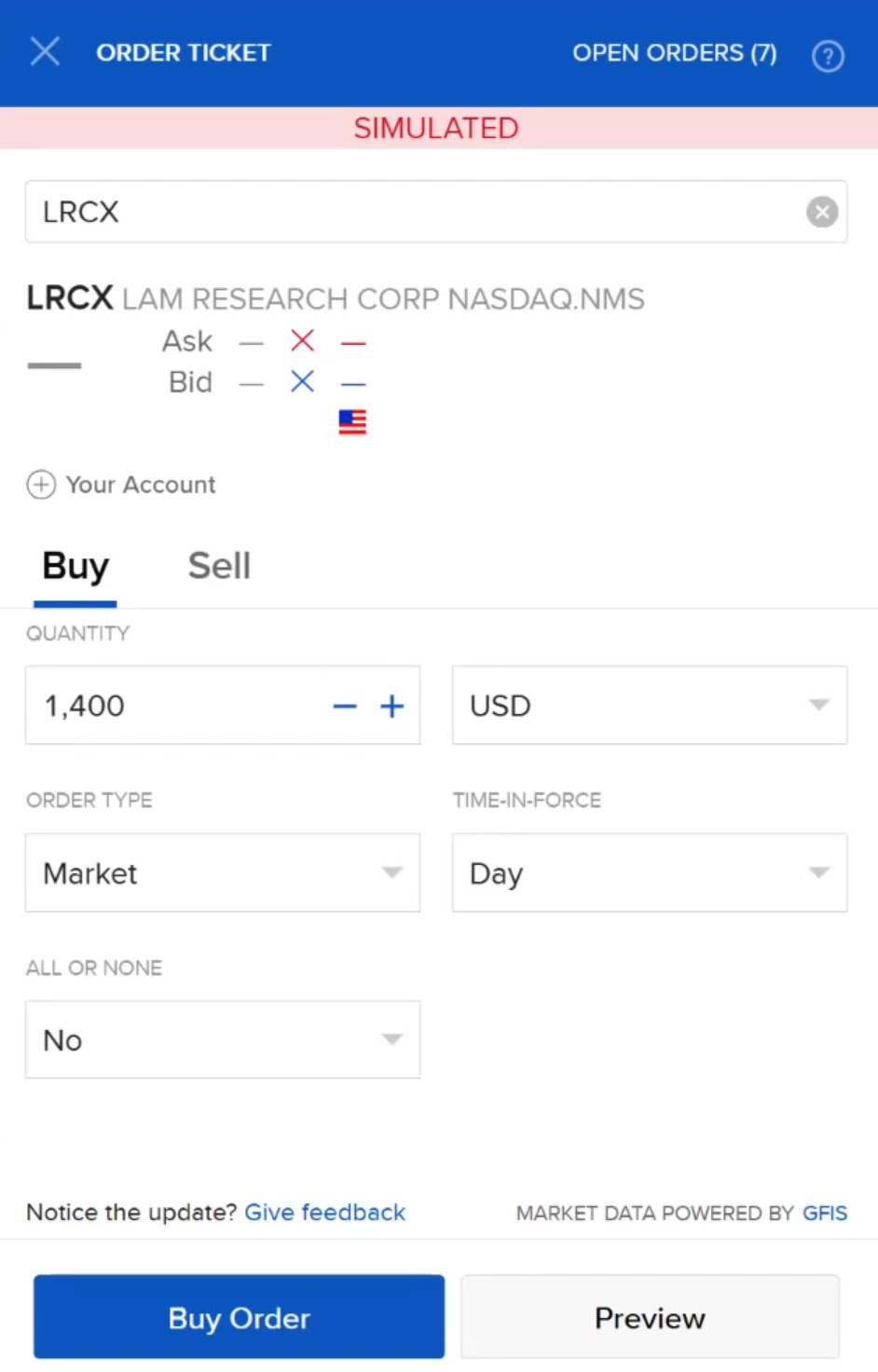

What you can do on your brokerage account if you want to enter a position differently.

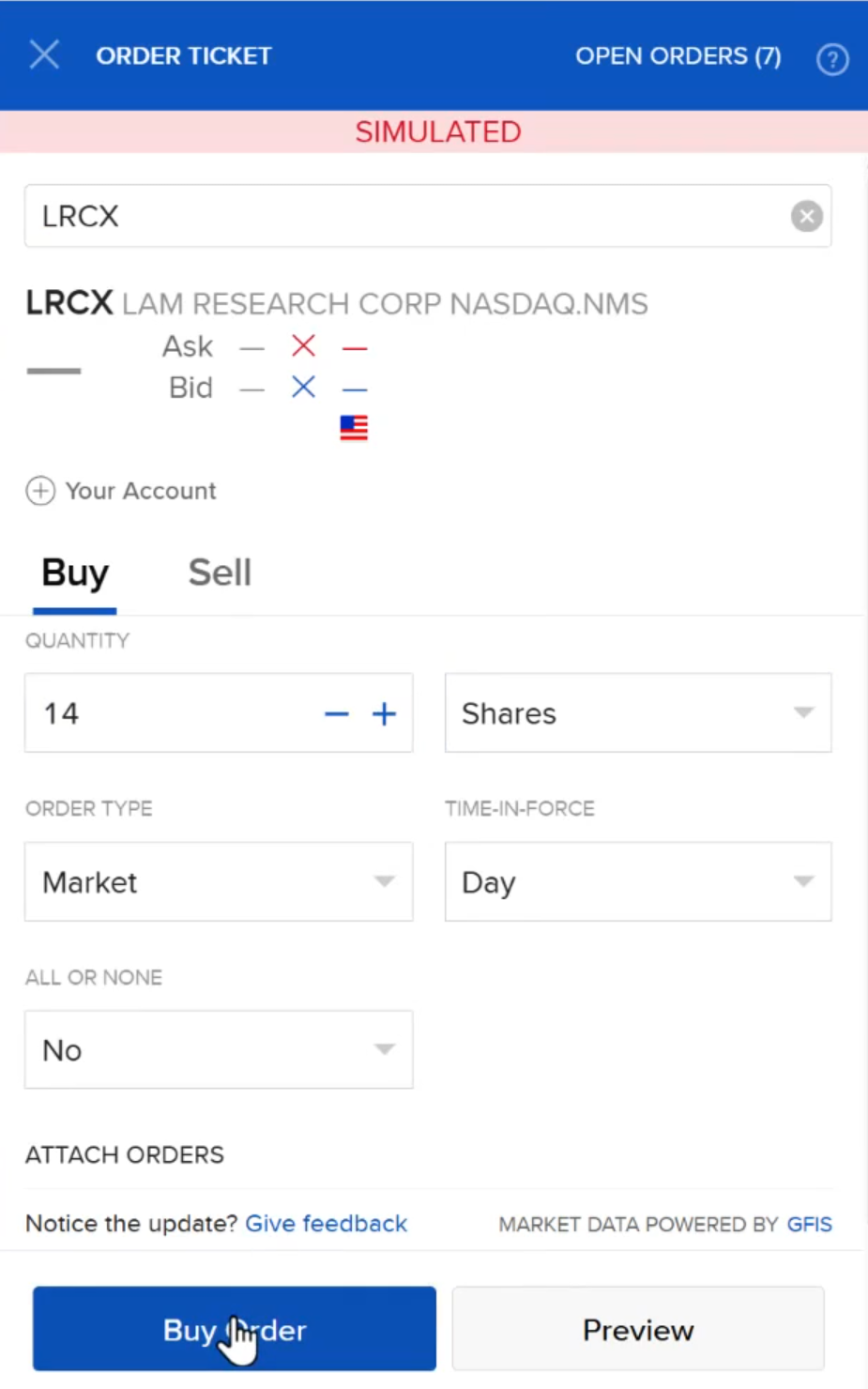

Let’s do it for LRCX

You simply click trade.

Look for LRCX.

This time around, instead of going to the position size to calculate how many shares to buy, you can just click here in US dollars, and you want to buy $1400 worth of LRCX.

Again, if you use the market price and you click OK

What happens is when the market opens later, what’s going to happen is that they will buy $1,400 worth of LRCK at the current market price.

You will likely get fractional shares in this case.

If you want to be more exact, more precise, use the position sizing calculator.

Don’t try to do what I just shared with you earlier, unless you don’t mind that little bit of uncertainty.

Example 2

On the first trading day of September, we are looking at this date over here.

The previous day’s closing price, we are here.

We are at $100.15.

What I’m going to do is LRCX.

I’ll put $100.15.

I need to buy almost 14 shares of LRCX.

What I’m going to do is again go down to my brokerage account.

14 shares of LRCX at market.

This is how we actually execute and implement the MOMO stock trading system.

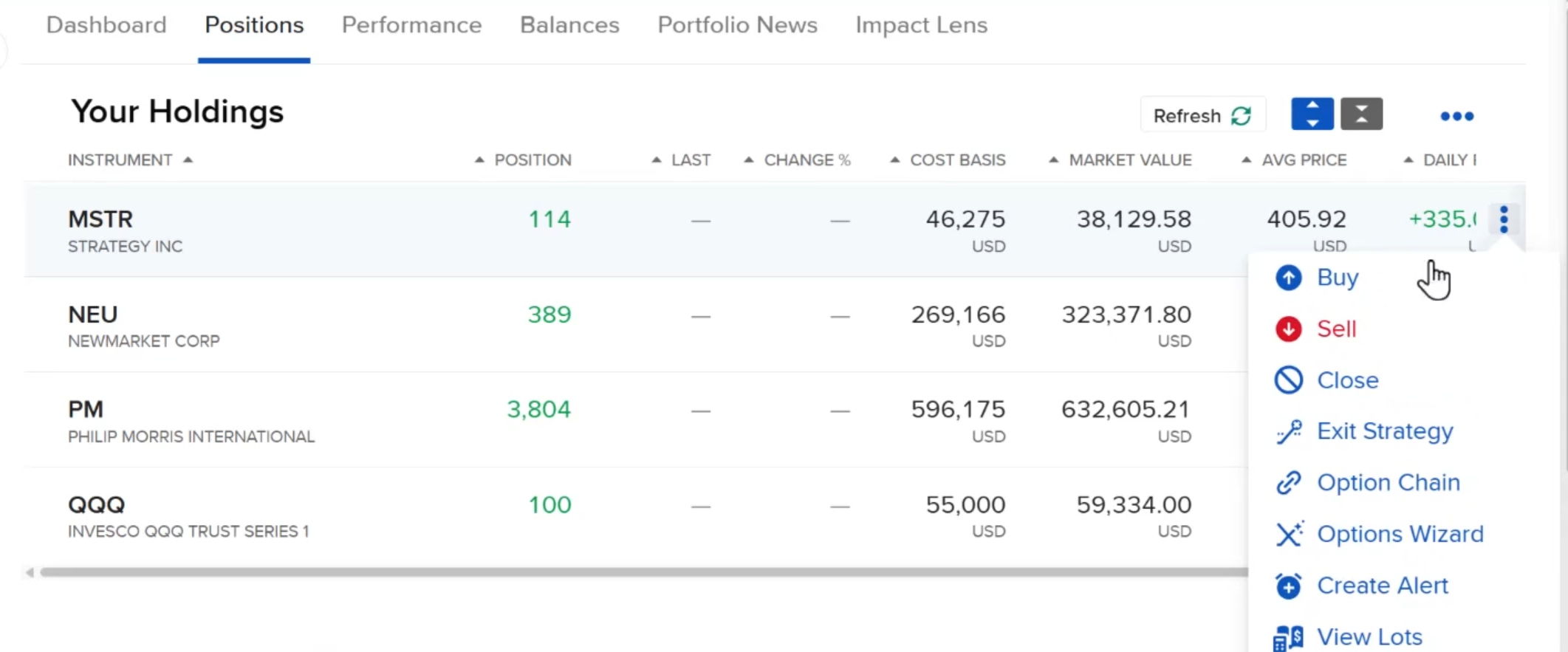

Exit Signal (Sell)

Again, if you need to sell…

We have an exit signal over here to follow.

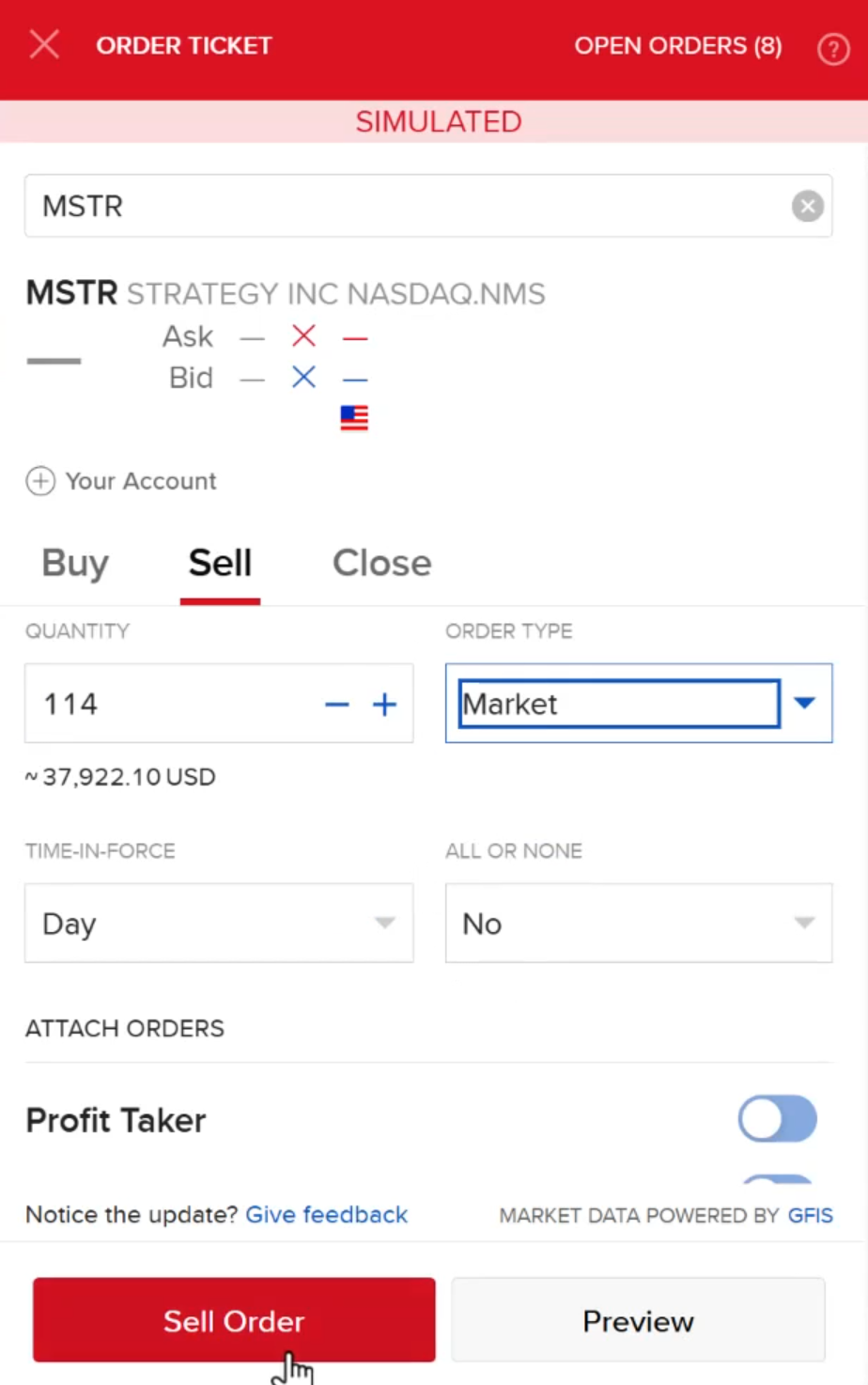

Let’s say, for example, I want to sell my MLSTR shares.

Just go to positions, click sell, and you can choose the quantity that you want.

In this case, I have 114 positions.

I’ll use a market price.

Usually, for the MOMO stock trading system, we always use the market price.

You just click the sell order, it’s going to go through when the market opens, and the positions will be sold.

This is how you do the sell orders for an Interactive Broker.

I hope you have clarity on this, and I’ll see you in the next video.