Download: Video | Transcript

Hey, hey, what’s up, my friend?

In this video, I want to walk you through and help you decide which of the trading systems you should begin trading with.

So, we’ll kick things off with understanding the different characteristics of the different trading systems that you’ve learned so far.

In case you’re wondering…

“Man, Rayner, you look kind of slimmer in this video.”

Here’s the thing…

The Ultimate Systems Trader, an online program, it’s always constantly being updated.

So, when the early videos were first being produced, I was about 10 kg heavier.

Right now, I’m doing the update to this program.

I’ve lost some weight, that’s why my chin looks sharper, my hair looks a bit different because I had a different hairstyle.

Along the way, in this course, if you feel…

“Man, Rayner, you kind of evolving, you look different.”

That’s kind of proof that we regularly update our courses.

Yeah, so anyway, that’s just kind of like to sidetrack a little bit.

Now, back to the program.

Characteristics Of Different Trading Systems

A quick overview of the different trading systems that you’ve learned.

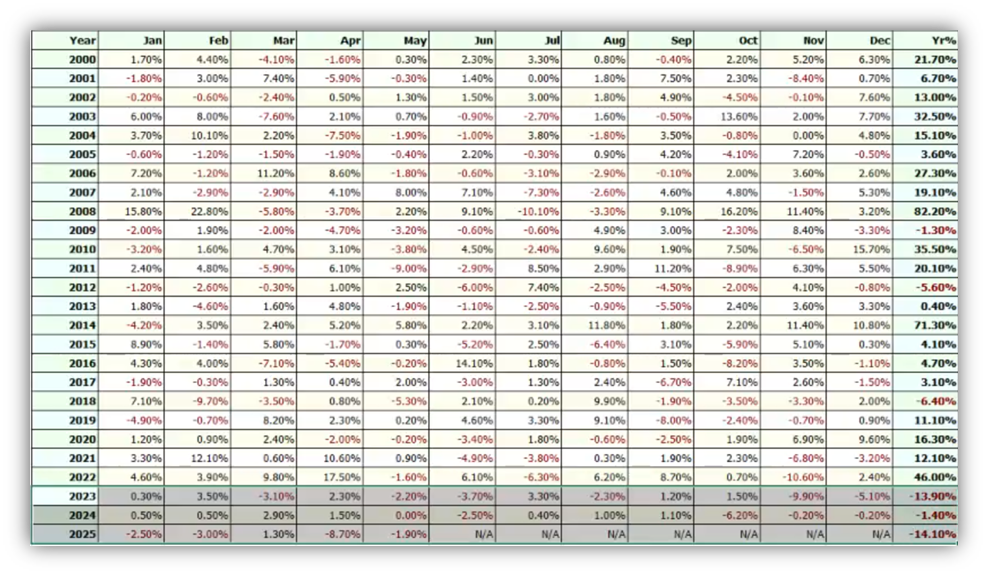

Systematic Trend Following (STF)

This system does well during a crisis period, even during a recession.

It rides trends across the different futures markets like Forex, commodities, Agriculture, etc.

The winning rate is on the lower side, about 30-40%.

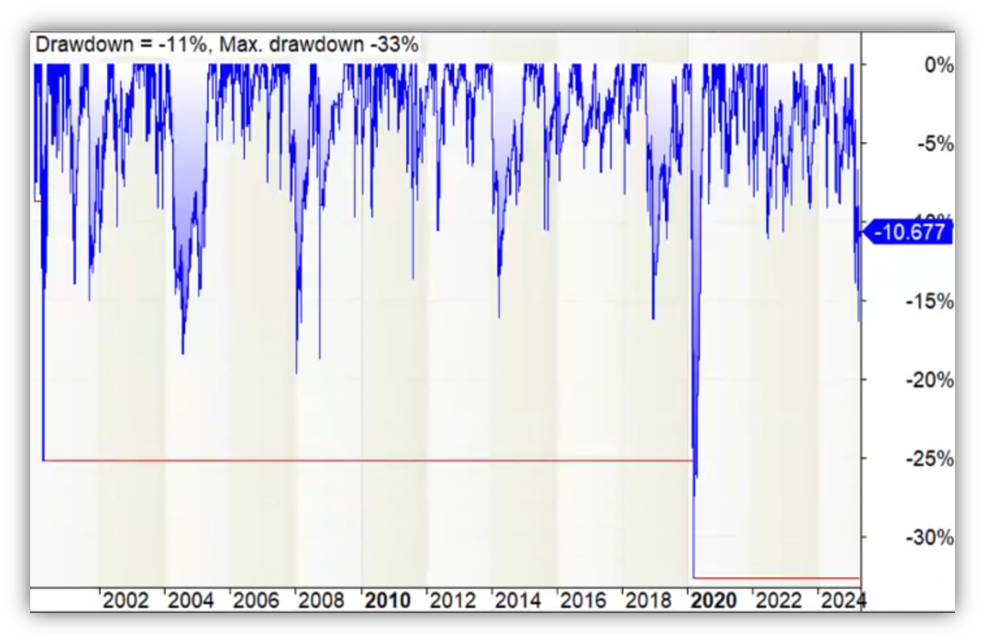

It has a high drawdown.

As of now, it’s about 30+% drawdown, and the duration of the drawdown is long as well.

You can be in a drawdown for years with this trading system.

It’s usually also why I recommend traders trade the system, kind of the last one.

We’ll get to that shortly.

Mean Reversion Trading (MRT)

The other trading system you’ve learned is the Mean Reversion Trading System.

It does well in a range market, a choppy market, and a choppy bullish market.

This trading system does well because it looks to capture swings in the market.

The drawdown is moderate, around about 30+% as of right now, winning rate of about 70%.

So it’s good, right, as a first system to get started with.

MOMO Stock Trading System (MOMO)

The MOMO Stock Trading System does well in the bull market, but the downside is that you will experience relatively high drawdown with this system.

Follow The Money (FTM)

It’s a system that is diversified away from the stock market because we trade ETFs like gold, commodities, bonds, etc.

It’s a low to moderate drawdown.

These are the four main trading systems that we teach in the Ultimate Systems Trading program.

Which Trading System To Start With

Which one should you get started with?

Assuming that you are a new trader, you have never been consistently profitable, and you have minimal trading experience.

Start with the Mean Reversion Trading System (MRT)

Mean Reversion Trading System (MRT)

The reason for this is that it has a relatively high winning rate, close to 70%.

It’s a daily trading system, meaning most days you have to place trades in the market.

This trains two things.

– It trains the repetitive habit of placing trades consistently in the market.

So you kind of understand what systems trading is about.

You’ve got to follow the rules religiously and place trades.

If it doesn’t get filled, you cancel those trades, or rather, you’ll be automatically canceled on your brokerage platform, and then the next day you place new orders again, right?

Basically, it gets you used to this repetitive process of following the rules systematically, because it’s a daily trading system, you get a lot more opportunities.

I recommend this one, and also, with its 70% winning rate, it’s going to be easier on your trading psychology.

The maximum drawdown we have experienced is about 30+%, but the median drawdown is about 20+%.

– It’s usually palatable for most traders to handle as well.

So, if you are new to trading and not yet consistently profitable, start with the MRT, would be my recommendation.

Once you get the hang of things, and then as you know, diversification of the trading system will reduce your risk and let you sleep better at night.

Trading System Combinations

Combo 1: MRT (50%) and FTM (50%)

The first combo that you can consider is a 50% Mean Reversion Trading System and a 50% to Follow The Money Trading System.

This allows you to spread your risk across different markets, and this will give you a smoother equity curve.

Combo 2: MRT (40%), FTM (40%), and MOMO 20%)

If you are comfortable with Combo 1 and you want to take things a step further, this is when you can try Combo 2

The Mean Reversion Trading System + The Follow The Money Trading System + The Momo Stock Trading System.

The MOMO Stock Trading System is a monthly trading system along with the Follow The Money Trading System.

But the thing about MOMO is that it’s more risky in the sense that you can expect a higher drawdown of this system.

The volatility of the system is higher compared to Mean Reversion Trading and Follow The Money System.

This is why over here, I reduce the percentage allocation for MOMO to 20%

Here’s the thing: you can adjust the percentage allocation to suit your risk profile.

If you find that you’re good with taking more risk, you’re good with your P&L fluctuating more aggressively…

You can switch up and have more allocation to maybe 30%.

Maybe 1/3 of all these three trading systems, or to a level that you are comfortable with.

There’s no one-size-fits-all.

It’s you as a trader, you’ve got to experience what you’re comfortable with, and as time goes by, you adjust the percentage allocation to something that suits your needs.

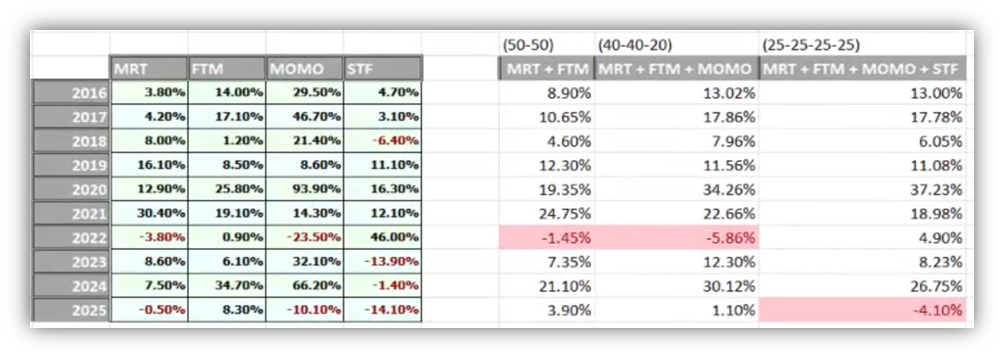

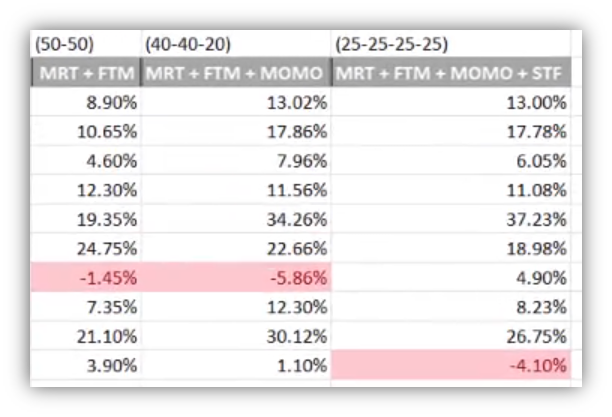

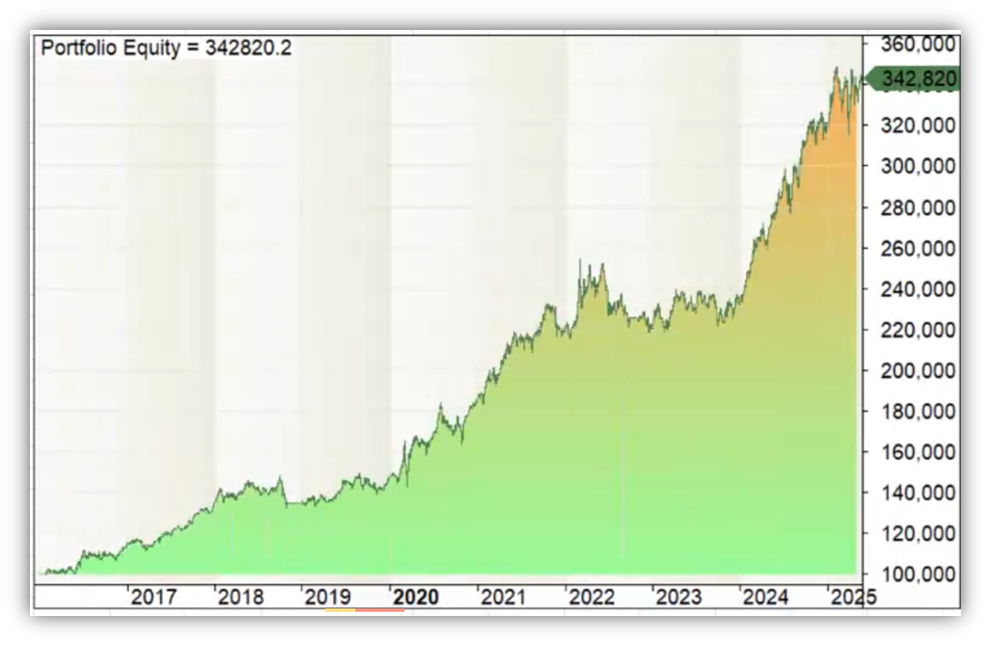

Just to walk you through so you can see what this looks like:

I start from 2016 because FTM, especially after the updated version, we only have data from 2016.

But you can see that if you were to go with, let’s say, 50/50 MRT and FTM:

So far, you have one losing year, which is 2022.

Other years are profitable, with quite a number of double-digit returns, and we have a few high single-digit returns as well.

If you have the 3-trading systems, MRT+FTM+MOMO (40,40,20)

Which I just shared earlier, you can see that your returns are juiced up, but your drawdowns will naturally be a bit higher as well.

In this case, you have a loss of about 5-6% in 2022

If you want to have all four trading systems, MRT+FTM+MOMO+STF (25,25,25,25)

I just simplified it to put a 25% allocation to each.

These are the results that you can expect

Recap

I would suggest that you don’t try to do too many things at once, don’t try to take too many trading systems at once, just go with the MRT first.

Understand the repetition, understand what it feels like to be placing orders almost every day in the market.

Once you nail down that process, then you can try multiple trading systems, and for starters, I recommend MRT and FTM.

Once you’re kind of proficient, you’re comfortable with it, then you can add in more systems, adjust the allocation to suit your risk profile.

Finally…

What About Systematic Trend Following Systems?

As mentioned briefly earlier, this trading system has a long period of drawdown.

You can be in the red for possibly years, and it’s very difficult for most new traders to handle because they can be following the rules every single day, week after week, month after month, and after 12 years, you’re still in the red.

Psychologically, this affects most people’s psychology.

They start to doubt themselves, they start to doubt the trading system, and they start to doubt the methodology.

I don’t recommend traders start this system from the start, because it is not the easiest trading system to trade.

However, there is still a huge benefit to this trading system, and it’s very good if you want to hedge your exposure to the stock market, especially if you already have a very long exposure to the stock market.

Maybe you have a lot of stock investments, which are going to make money in the bull market, but bear market, all your stock investments, chances are, they’re going to be correlated, they will go down at the same time.

If that’s the case, then STF can provide this added benefit of diversification for you.

In a bull market, your stock investment will make money.

STF may or may not be, but in the bear market, at least you know, this is something that has a high chance of giving you protection during the bear market.

Likewise, if you have several stock trading systems that make money in the long side of things, but in a bear market don’t make money, then again, you can consider adding STF, but once again, I want to repeat…

Don’t…

I mean…

If you are a new trader, you are not yet consistently profitable, don’t add STF or don’t trade it at the start, because psychologically it’s one of the most demanding trading systems, if you ask me, in terms of the mental aspect of it.

Equity Curves Of The Trading Systems

This is something that you all would have access to in the resource section.

Systematic Trend Following Trading System (STF)

You can see that STF, this is a period of drawdown from 2014-2015, and you only break out the new equity highs sometime in some time 2020.

Here, there’s a new equity high broken up briefly after like 3-4 years, and then the real legit big move was actually after I think a good after like 6-7 years.

You can see that you’ve been drawn up for quite a period.

Right now, we are in a 35% drawdown.

You can see that currently, 2023, 2024, and 2025 are not looking too good for Systematic Trend Following Systems.

You can imagine this, you started, let’s say…

2022 or the end of the year. This system is amazing…

Let me get started in 2023 early.

You’re in a drawdown till today.

Psychologically, it’s going to be very challenging for most traders to handle.

Whereas you look at the Mean Reversion Trading System, you can see that the drawdowns are shallower and the length of the drawdown is much shorter as well.

You can see that it makes a pullback.

This is what we call a drawdown, then shortly afterwards…Boom

Breakout to new all-time highs.

Draw down, then shortly afterwards break out to new all-time highs.

So, from a psychological standpoint, it’s much easier to handle the reversion trading system and the average drawdown; the median drawdown is around 15%

But in all, most of the time, the drawdown usually doesn’t exceed more than 20%

Follow The Money Trading System (FTM)

You can see this is again a system that trades once per month.

So, you can trade FTM as the first system as you want, but because it trades once per month.

I don’t recommend it because it doesn’t get you in the groove of placing trades repetitively and getting into the habit of that process of training your actions, your mental state, to be putting trades every single day.

This is why I recommended the MRT trading system.

But of course, if you want to go with FTM as the first system, because maybe you’re a busy professional, you run a business, you don’t have much time.

Then yeah, this will be a good system to start with because it’s a pretty good risk-adjusted return.

You can see that since the inception, the annual return is about close to 14%, and the maximum drawdwon has been about 14% as well.

I think it’s one of the best risk-adjusted trading systems that we have.

I’ve come to the end of this video, and i will see you in the next one.